capital gains tax proposal effective date

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. In 2022 it would kick in for single filers with taxable income over 400000 and for married couples at 450000.

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

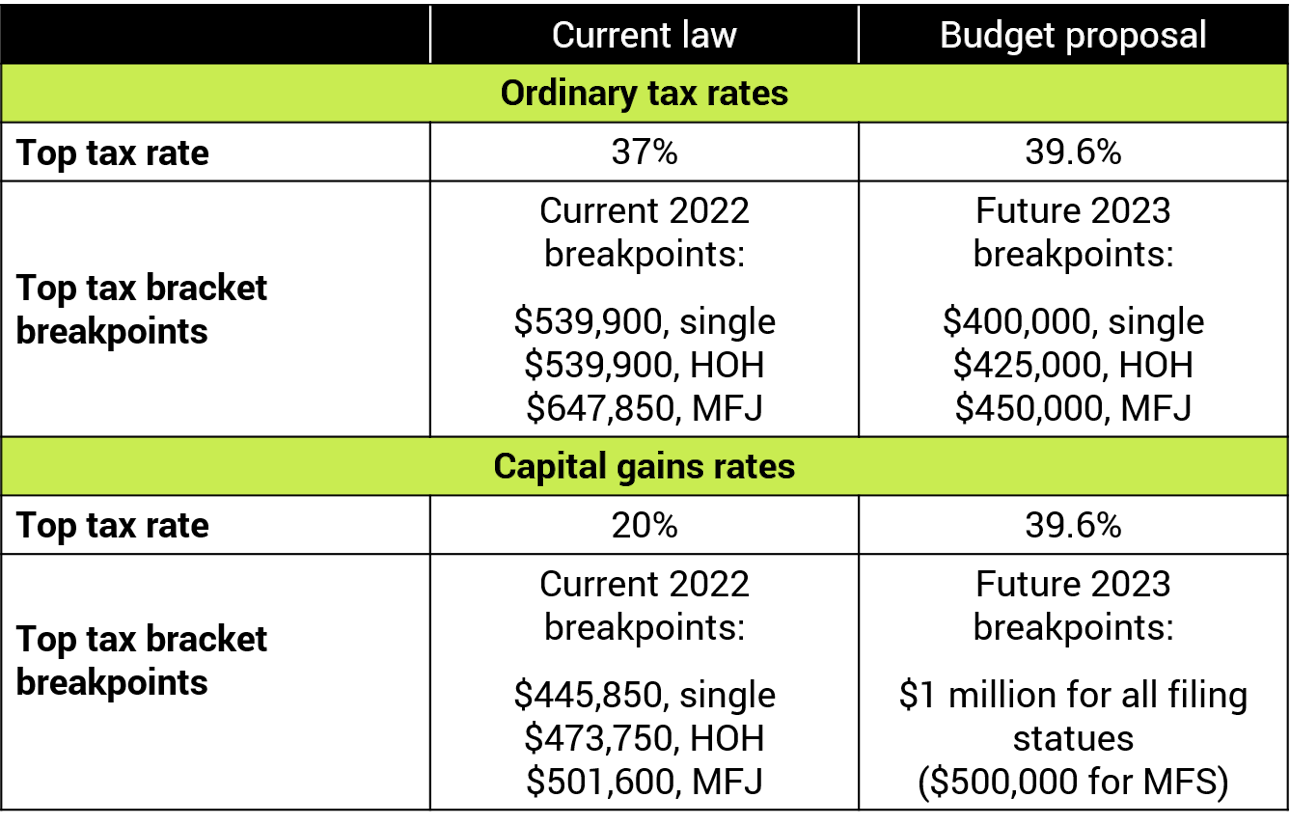

Raising the top individual rate to 396.

. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive. Iii From a top individual rate of 882 to rates ranging from 965 to 109. The new rate would apply to gains realized after Sep.

The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that. Gimigliano Principal Washington National Tax KPMG US 1 202-533-4022 Podcast overview President Biden has proposed a. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a.

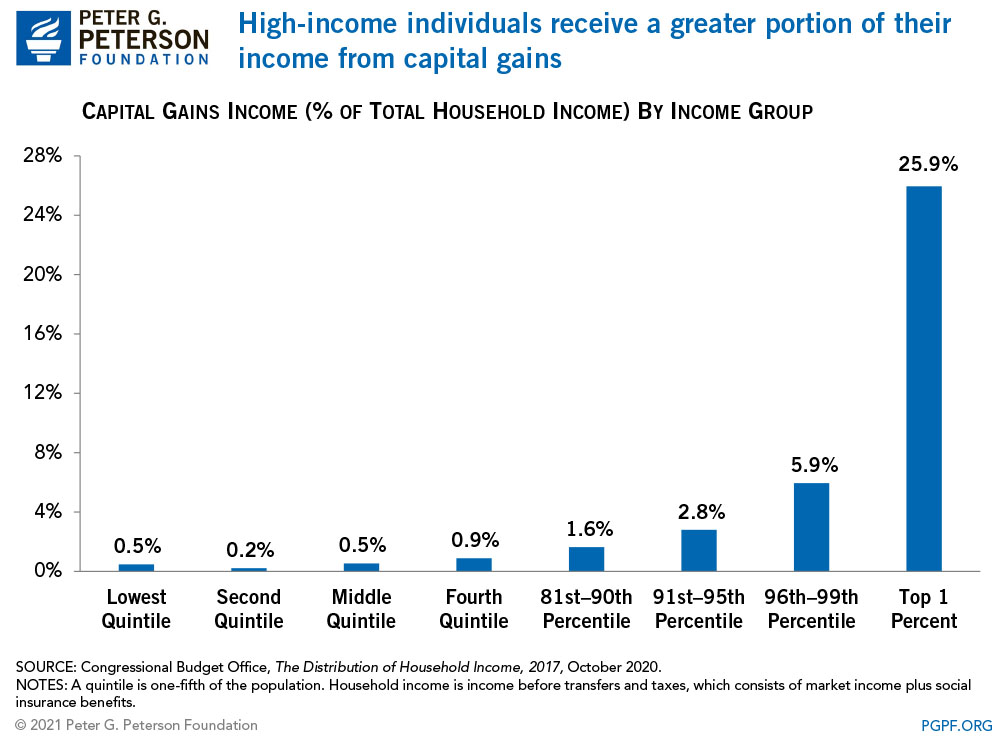

Raising the top capital gains rate to 396 for households with more than 1 million in. As American taxpayers await the unveiling of the Biden Administrations tax proposal investors cant help but uneasily imagine the effects it will have. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. The major tax increase proposals include. The Treasury provided further detail and guidance into the matter through the release of its General Explanation of the Administrations Fiscal Year 2022 Revenue Proposalsie the.

The House bill would apply the increase to gain recognized after September 13 2021. May 14 2021 Listen Now 2623 Download Subscribe John P. The proposal would be effective for taxable years beginning after December 31 2022.

1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April. The estate and gift proposal would be effective for gains on property transferred by gift and on property owned at death by decedents dying after December 31 2021. The proposed effective date for most of the changes is January 1 2022 unless otherwise noted.

The effective date for most of the proposals is Jan. By QSBS Expert. We last saw a proposal to impose additional taxes on high-income individuals estates and trusts in the.

April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the. That same business owner could net 126 million due to the proposed increase in the.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Sdr Blog The Biden Tax Proposal What You Need To Know

Managing Tax Rate Uncertainty Russell Investments

How Are Capital Gains Taxed Tax Policy Center

Effects Of Changing Tax Policy On Commercial Real Estate

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Dems Eye Pre Emptive Capital Gains Effective Date Grant Thornton

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

An Overview Of Capital Gains Taxes Tax Foundation

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Biden S Capital Gains Tax Plan May Be Retroactive Worrying Top Bank Ceos Fox Business